Simplify cross-border operations and manage multiple currencies in one place. Send funds internationally without the hassle of managing multiple bank accounts.

* 以這些貨幣收到的資金會兌換成美元

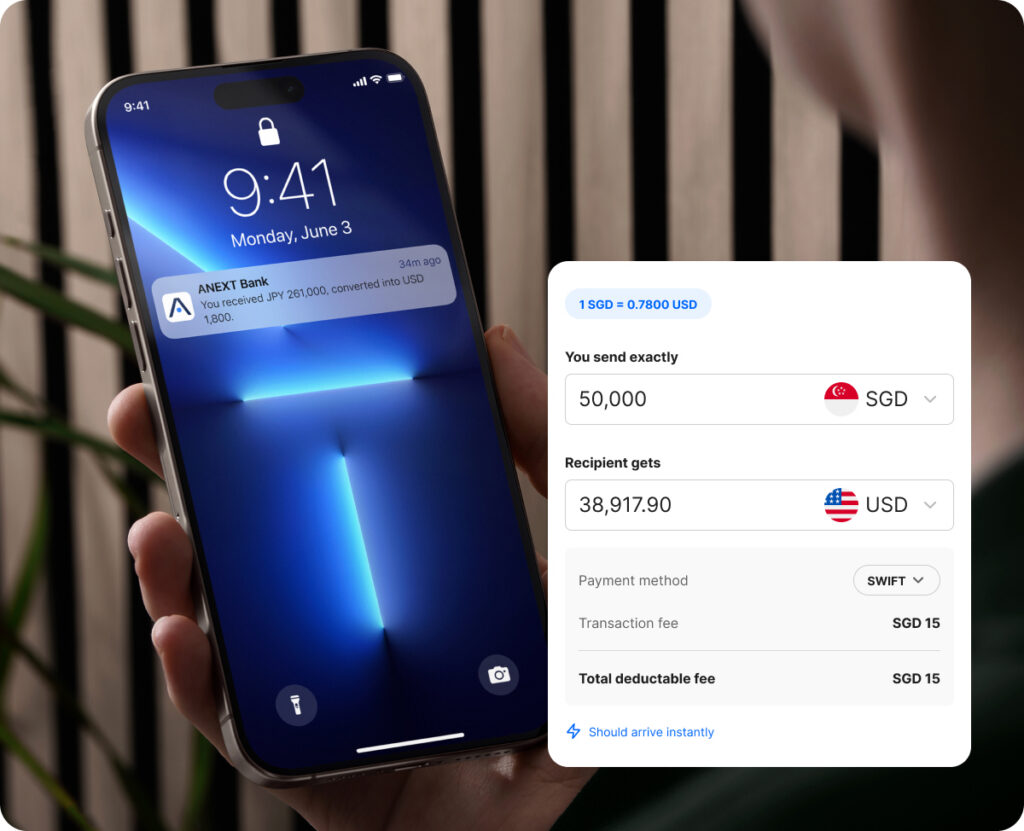

Move money across borders with transparent flat fees – so your costs stay predictable as your business grows.

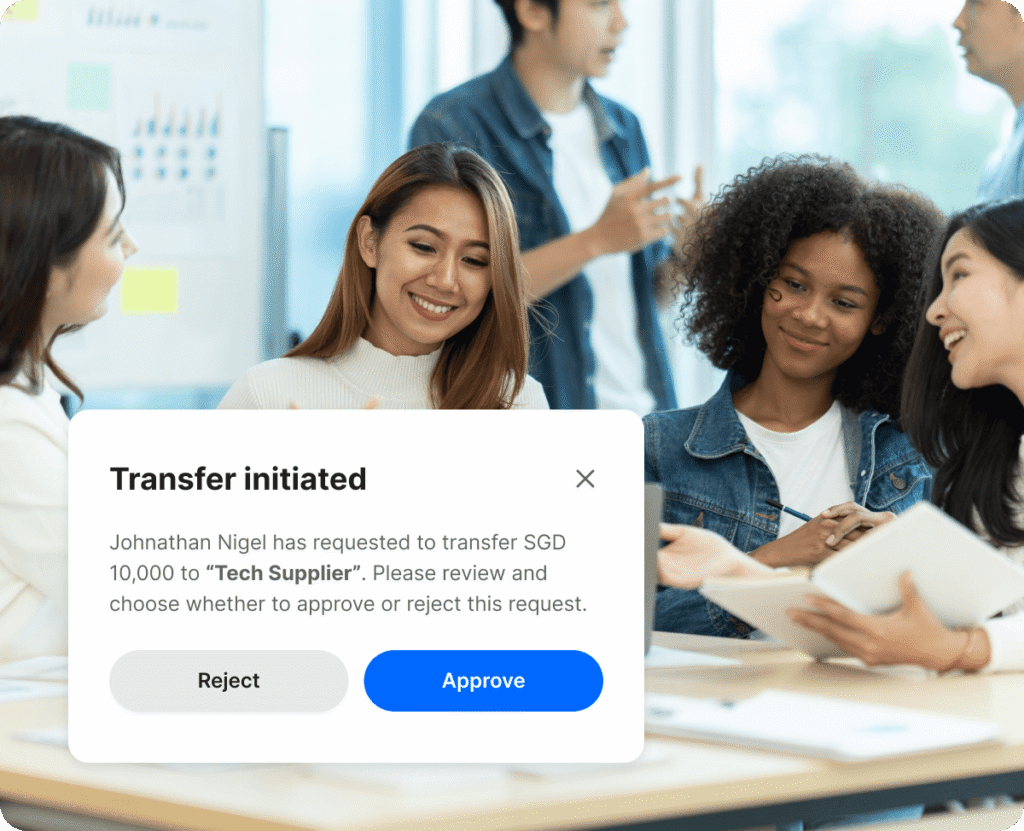

隨著您公司的擴充,可增加無限制的使用者。為您的團隊提供所需的存取權限,而您則保持完全的可見性和控制權。.

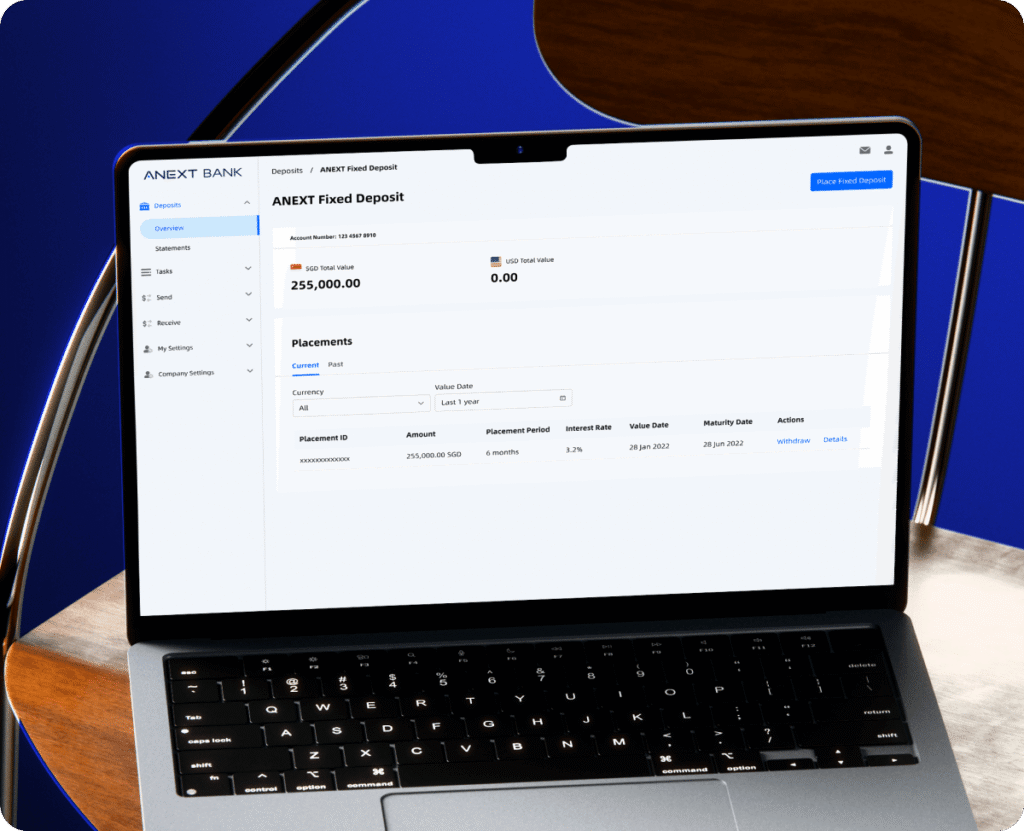

Earn fixed interest on your idle funds starting from USD 5,000 with flexible tenures. Enjoy the flexibility of short placement periods, and earn interest in multiple currencies.

目前,一個企業只能申請和維持一個 ANEXT 商業帳戶。.

Scheduled transfers are available via payment channels FAST, GIRO and MEPS and will be submitted at 00:00 of the indicated scheduled date. Credit timing depends on the channel. Do note that if you’re selecting the MEPS channel, you can only schedule the transfer on a working day in Singapore.

You can receive SGD via PayNow/FAST/MEPS/GIRO. ANEXT does not charge an additional fee for incoming SGD transfers, subject to applicable limits.

For PayNow, log in to Online Banking, navigate to PayNow Settings > My QR > Download to provide your PayNow ID or unique QR.

For FAST, MEPS or GIRO, here are the information that your remitter’s bank may require:

To set up your PayNow ID:

Step 1: Log in to Online Banking and navigate to PayNow > PayNow Settings > Click the ‘Register New’ button on the top right-hand corner.

Step 2: Your UEN will be your PayNow ID by default. If you’ve linked your PayNow ID to another bank account, simply select 3-alphanumeric characters that will be added to the end of your existing PayNow ID e.g. if your 3-alphanumeric characters is AB1, your PayNow ID will be 1234567AB1

Step 3: Review and confirm the request.

You can also generate a QR Code that’s valid for as long as your account is in operation to receive funds instantly into your ANEXT Business Account. Navigate to PayNow Settings > My QR > Download. Do note that your payee will need to input the transfer amount upon scanning the QR Code.